Introduction to Internet Capital Markets

This article delves into the concept of Internet Capital Markets (ICM), highlighting their differences from traditional financial systems and explaining why Solana is becoming a key player in this innovative landscape. From meme tokens to AI-driven applications, ICM are making finance more accessible, eliminating the need for banks or brokers, and enabling global participation.

Understanding Traditional Capital Markets

How Traditional Capital Markets Function

Capital markets are essential to the global economy, facilitating the connection between investors with surplus funds and enterprises seeking capital for growth, innovation, or debt management. They operate through primary markets, such as IPOs for issuing securities, and secondary markets, like stock exchanges, for trading.

Challenges of Traditional Capital Markets

Despite their effectiveness, traditional capital markets face several constraints:

- High entry barriers due to wealth, location, or legal restrictions

- Reliance on intermediaries like banks and brokers

- Restricted trading hours

- Complex regulatory frameworks

Defining Internet Capital Markets and Their Unique Features

What Are Internet Capital Markets?

Internet Capital Markets (ICM) are decentralized, online-native platforms that enable instant, borderless trading and investment without intermediaries like banks or brokers.

Key features include:

- 24/7 global accessibility

- Minimal transaction costs

- Peer-to-peer trading and fundraising

- Instant liquidity through tokenization

- Open to anyone with an internet connection

Comparing ICM to Traditional Markets

| Feature | Traditional Capital Markets | Internet Capital Markets (ICM) |

|---|---|---|

| Access | Limited by geography, wealth | Open to all with internet |

| Intermediaries | Banks, brokers | None |

| Trading Hours | Business hours only | 24/7 |

| Speed | Slow settlement times | Instant transactions |

| Innovation Pace | Gradual | Rapid idea-to-token launch |

Why Solana Is a Leader in Internet Capital Markets

Solana’s Technical Strengths

Solana stands out as one of the fastest and most cost-effective blockchains, making it a perfect fit for hosting decentralized finance protocols that power ICM:

- Sub-second transaction confirmations

- Fees as low as $0.0001

- High capacity, processing over 65,000 transactions per second

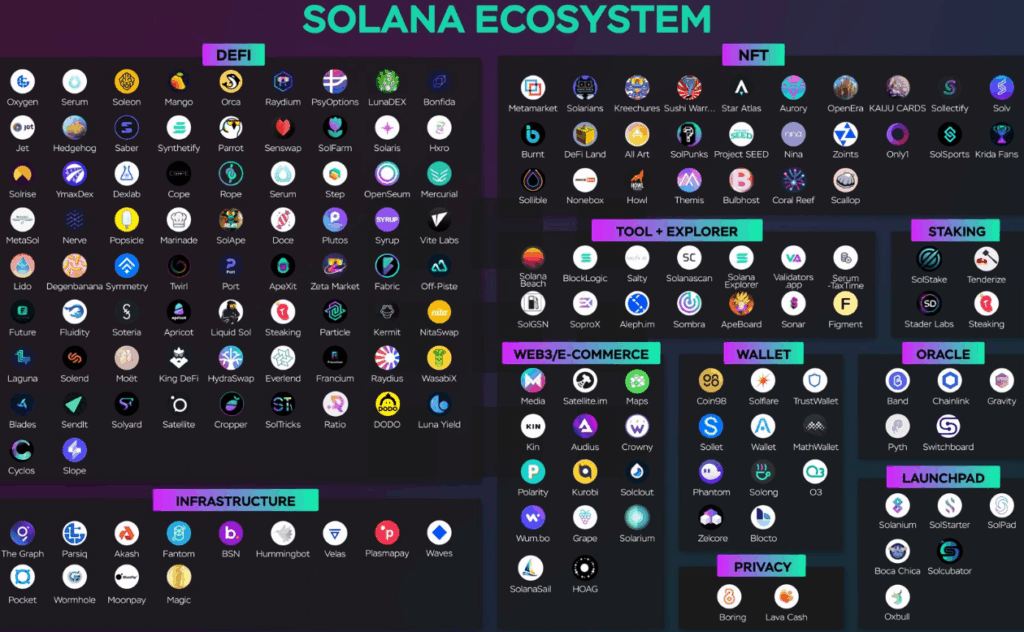

A Developer-Friendly Ecosystem

Solana provides an array of tools, SDKs, and launchpads that foster ICM innovation. Developers can:

- Create tokens using smart contracts

- Raise funds directly from users

- Access Solana’s DeFi liquidity pools

Discover: Solana vs. Cardano: A Comparative Analysis

Notable Projects Driving Internet Capital Markets on Solana

Innovative ICM Projects on Solana

- LAUNCHCOIN: A crowdfunding token platform where anyone can launch a token for their idea, gaining community funding if it resonates.

- DUPE: Add “dupe dot com” before a product URL to find cheaper alternatives, incentivized by tokens for comparison shopping.

- BUDDY: An AI assistant for managing X (Twitter) accounts, offering 8 creator-focused tools.

- FITCOIN: A virtual AI wardrobe app for creating, reselling, and sharing outfits, with over 1M items uploaded.

- GIGGLES: A short video app rewarding user engagement with tokens, rumored to be linked to Google.

- SUPFRIEND: An AI tool for visualizing and interacting with codebases, supporting multiple programming languages.

Opportunities and Risks in Internet Capital Markets

Potential Benefits

- Access to early-stage investment possibilities

- Greater financial inclusivity

- Fast-paced innovation in consumer finance, AI, and tokenomics

Associated Risks

- Significant market volatility

- Risk of fraudulent projects or rug pulls

- Lack of regulation and due diligence

The Future of Finance

Internet Capital Markets are transforming the way people invest, fund projects, and engage with finance. With blockchains like Solana at the helm, ICM delivers speed, inclusivity, and innovation that traditional systems can’t match.

However, this new frontier isn’t without challenges. Thriving in ICM demands education, thorough research, and community accountability. For early adopters and creators, the potential rewards could be groundbreaking.